- Consumer Spend across Visual Home Entertainment rose to £5.1bn[1] in 2024, the highest ever recorded figure for the sector, and the first time it has passed the £5bn mark, inclusive of all SVoD, DIGITAL and DISC sales, and rental (PEST, PVoD, EST, VoD, DVD, BLU-RAY, 4K UHD, RENTAL, BOXSET)

- Consumer Spend across Visual Home Entertainment rose to £5.1bn[1] in 2024, the highest ever recorded figure for the sector, and the first time it has passed the £5bn mark, inclusive of all SVoD, DIGITAL and DISC sales, and rental (PEST, PVoD, EST, VoD, DVD, BLU-RAY, 4K UHD, RENTAL, BOXSET)

- The value of the UK Screen Industry grew by 4.3% to £12.4bn[2], inclusive of SVoD, Premium AVoD, TVoD/EST, Physical, Cinema and Pay TV

- The total value of the UK Entertainment Industry rose to £30bn[3] in 2024, including Transactional, Pay TV Home Entertainment, Cinema, Games and Music.

- The total number of new releases on Visual Home Entertainment (Disc, EST and VOD) in the UK hit 1605[4] in 2024, complementing the 1114[5] released in cinemas across the year

- The total number of films released to buy or rent at home at a premium price (Premium Video on Demand (PVOD) and/or Premium EST (PEST)) went up by 15% to 62[6] in 2024 as audiences chose to watch films at home fresh-from-cinema as soon as possible, where the average window from Theatrical premier to PEST or PVOD was 40 days[7]

- The Premium Video on Demand window delivered £12.8mn in the UK in 2024 across 807k transactions[8] with an average price of £15.80 while the Premium Electronic Sell-Through window delivered 1.5mn transactions, at a value of £28.5mn[9] with an average unit price of £19.60

- The total value of the Digital Transactional market remained stable in the UK in 2024 at a value of £381mn, and is set to rise by 2.4% in 2025[10]

- Fan favourite physical format Blu-ray 4k grew by 21% YoY in 2024, with 1.3mn[11] unit sales at a value of £30.5mn, up 17.8% YoY[12], where 4K re-releases of catalogue titles ALIENS, THE TERMINATOR, THE CROW and THE LORD OF THE RINGS contributed to the growing success of the format

- 6mn[13]UK Homes accessed a Subscription Video on Demand (SVoD) service in 2024 with an average of 2.9[14] services per household in the UK, an increase of 2% YoY[15]

- The introduction of advertising-supported tiers across all SVoD added £400mn[16] to the consumer value of the UK Home Entertainment Market in 2024, while the addition of advertising contributed to a 36% YoY growth for UK premium advertising-supported online video revenue (incl. hybrid SVOD advertising, Premium AVoD and FAST) which rose to £1.7bn[17]

- The most popular streaming service in the UK in 2024 was Netflix (59% – 17.3m homes)[18], followed by Amazon Prime Video (46% -13.4m homes) and Disney+(26% – 7.5m homes)[19]

- There are more than 750 FAST channels in the UK, across the most popular eight FAST-enabled services[20]

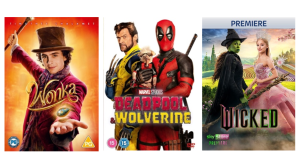

- Warner Bros. Discovery was the leading transactional distributor in the UK for the third year running with a 22.8%[21] volume market share, led by number one title of the year WONKA[22] (based on data from the Official Chart Company) which converted its Christmas 2023 theatrical premiere in to the biggest Home Entertainment film of 2024 with 821k[23] across digital and disc, inclusive of PEST, PVoD, EST, VOD, Blu-ray and DVD

- Timothée Chalamet’s popularity was cemented as DUNE: PART TWO[24] journeyed to the number two spot in the chart, selling 817k [25] units across disc and digital. DUNE: PART TWO was also the top selling title on disc, selling 132k[26] copies on Blu-ray and DVD combined, and was the top-selling Blu-ray overall with a value of £1.5mn[27]

- Following a significant 2023 performance, Universal Pictures’ Christopher Nolan’s Best OSCAR™ winning smash OPPENHEIMER[28] blew away the rental competition, helping it grab the third biggest title of the year across all formats selling an additional 713k[29] units, and the number one Video on Demand (VOD) title overall for the year, with 487k[30] rental transactions in 2024

- Disney’s DEADPOOL & WOLVERINE[31] was the biggest EST title selling 465k[32] units in that format, and 5k[33] units in total, helping it to secure the fourth biggest selling title of 2024 overall. Buying a film at home (Electronic Sell Through or EST) was the most popular way for audiences to buy and keep a film in the UK in 2024

- Warner Bros. Discovery’s BARBIE followed it’s 2023 success, by grabbing the number five spot in the 2024 chart across all formats selling another 562k[34] units, bringing its total UK transactional sales to 1.3mn[35] (since its release in 2023) and was the number four rental title for the year, followed closely by number five rental film, Sony Pictures’ Sydney Sweeney led and produced ANYONE BUT YOU[36]

- Lionsgate’s THE HUNGER GAMES: THE BALLAD OF SONGBIRDS AND SNAKES was the biggest title from an Independent Studio, with 347k sales across all formats, and a value of £3.5mn, where the total number of units sales of the top 10 independent titles combined was over 2mn[37]

- Paramount Pictures’ A QUIET PLACE: DAY ONE, was the top selling horror title of 2024, with 232k[38] sales across all formats.

- GAME OF THRONES: HOUSE OF THE DRAGON[39] ruled the Official TV on Video Chart for the third year running, with a further 31k[40] sales, adding to the 24k[41] sales of Season Two, while combined sales of all Doctor Who titles in 2024 on disc was 200k[42], at a value of £4.5m[43]

London, 27th January 2025: Today, full market data for 2024 released by the British Association for Screen Entertainment (BASE) in association with the Official Charts Company confirms that Video is officially the most popular form of entertainment in the UK.

The total value of the media and entertainment industry in the UK in 2024 was a staggering £30bn[44] which includes transactional and Pay TV Home Entertainment, Cinema, Games, and Music. The value of the UK Home Entertainment Category accounted for 17% of that number and grew to £5.1bn[45] in 2024 inclusive of all SVoD, PVoD and VOD, PEST and EST, DVD, BLU-RAY, 4K UHD, and BOXSETS. The total value of the UK Screen sector rose to £12.4bn.

This growth is despite the impact of the 2023 Screen Actors Guild (SAG-AFTRA) and Writers Guild of America (WGA) strikes on the film slate at the beginning of 2024, and the subsequent delays on film and TV production. A resurging slate throughout the year ensured the UK Box Office rose in the final quarter of 2024, delivering a value of £145m[46] in November 2024 across films such as WICKED, PADDINGTON IN PERU, MOANA 2, GLADIATOR 2, and MUFASA: THE LION KING. The strength of the 2025 slate, which includes BRIDGET JONES: MAD ABOUT THE BOY, MISSION IMPOSSIBLE: FINAL RECKONING, SUPERMAN, WICKED: FOR GOOD, and AVATAR: FIRE and ASH, plays a huge part in the prediction that Home Entertainment will grow by 2.4%[47] in value in the UK in 2025.

The total number of films released across transactional Home Entertainment was 1605[48], where consumers understand they can take advantage of ad-free entertainment, complementing the 1114[49] films released in cinemas across the year. The total number of films released to buy or rent at home at a premium price (Premium Video on Demand (PVOD) and/or Premium EST (PEST)) went up to 62[50] in 2024, as audiences chose to watch fresh-from-cinema films at home as soon as they were released on Digital Service Providers (DSPS).

Liz Bales, Chief Executive, BASE said: “Visual Entertainment is the most popular entertainment pastime in the UK and audiences make savvy choices across the spectrum of Home Entertainment formats available to them, spending in excess of £5bn. Premium digital formats have already set records in 2025, just a few weeks into the year: WICKED was released on PVoD and PEST on January 3rd and became the most popular Premium title since records began in the UK. Ad revenue has added £1.7bn across the range of online video services in the UK, and £400mn to consumer spend on SVoD, while simultaneously there were 73[51] more FAST channels launched across all FAST services in the UK since the beginning of the year, where the total number is now well over 700, enabled by the likes of Samsung, LG, Roku and others to bring the digital high-street directly to consumers living rooms. While audiences love film and TV shows the industry will continue to grow and evolve, to offer more and better.”

Consumer uptake of streaming services (Subscription Video on Demand or SVoD) in 2024 rose to 54.1m (+2% YoY)[52] with 70%[53] of UK subscribers choosing services that include ads for a reduced subscription fee. The value of the sector rose to £4.5bn (+8% YoY)[54] supported by the introduction of advertising, and the additional tiers available to consumers, who can still choose to watch without advertising for a higher fee. The addition of advertising contributed to a 36% YoY growth for UK premium advertising-supported online video revenue (incl. hybrid SVOD advertising, Premium AVoD and FAST) which rose to £1.7bn[55].

The Digital High Street continued to evolve, with ‘bundling’ of multiple streaming services under one offer from hardware suppliers such as SKY, LG, and SAMSUNG, proving popular with audiences, and driving growth for the industry, where 1 in 5 global online video subscriptions are now part of a ‘bundle’ of services[56]. The most popular individual streaming service in the UK in 2024 was Netflix[57], followed by Amazon Prime Video[58] and Disney+[59]. The revenue from free channels to view supported by ads (Free Ad Supported Television or FAST) is predicted to double in the next five years, rising to £9.7bn[60] by 2029. Monthly Average Users (MAU’s) for services offering FAST channels have more than doubled from 5% in Q3 2021 to 13% in Q3 2024, driven primarily by PLUTO, SAMSUNG TV+, LG Channels, and FREEVEE, which has now moved its FAST channels to Amazon Prime[61].

The top title of 2024 in the UK across all transactional formats was Warner Bros. Discovery’s WONKA with 821k[62] individual purchases or rentals of the film by audiences across Home Entertainment. This figure includes all sales and rentals of the film across Digital and Disc (EST, VOD, Blu-ray and DVD). (Official Charts Company measures individual content purchases on disc and digital, to rent, buy or own in the UK, unlike multi-content SVoD services.) Another Warner Bros. Discovery title, DUNE: PART TWO, took the second spot on the top titles of 2024 chart, selling 817k [63] units to buy or rent on digital or disc. DUNE: PART TWO was also the top selling title on disc, selling 132k[64] copies on Blu-ray and DVD combined, with a value of £2m[65], playing a part in the continuing £156.3m[66] value of the UK market for films and TV on disc in 2024.

Following its success as the biggest disc title of 2023, OPPENHEIMER was the biggest selling VOD title in the UK in 2024, selling 487k[67] units. This continued popularity for the Christopher Nolan epic helped OPPENHEIMER grab the number three spot in the overall chart, with total sales of 713k[68] across all formats.

Disney’s DEADPOOL & WOLVERINE was the biggest selling title on EST with 465k[69] units sold since its UK Home Entertainment digital release on October 1st 2024, following its £60m[70] performance at the UK Box Office in July 2024, before its Disney+ premier in the UK on November 12th 2024. This helped DEADPOOL & WOLVERINE snatch the number four spot in the overall chart, with a total of 621k[71] purchases across all formats. Buying at home (EST) proved incredibly popular with families, in a fantastic year for children’s films: INSIDE OUT 2 followed an impressive Box Office performance of £61m[72] to become the fourth biggest selling title to buy at home (EST) with 253k[73] units sold before it’s Disney+ debut on September 25th, followed closely in to fifth spot by DESPICABLE ME 4, with 191k[74] download sales, following a UK Box Office of £51mn[75]. Family films also ended the year on a high at the UK Box Office, with PADDINGTON IN PERU[76], WICKED[77], MOANA 2[78], SONIC THE HEDGEHOG 3[79], and MUFASA: THE LION KING[80] all ensuring families had lots to watch and enjoy on the big screen, titles which will premier to buy or rent at home in the first half of 2025.

Following the huge success of BARBIE in 2023, female led films continued to breakout at the Box Office and at home. With 562k[81] more sales in 2024, BARBIE secured the 5th spot in the overall chart, making its total sales to date 1.3m[82]. Sydney Sweeney was both the lead and Executive Producer of romantic comedy ANYONE BUT YOU which followed a UK Box Office of £11.5mn[83] with total sales of 445k[84] on Home Entertainment, and proving particularly popular with renters, helping it grab the number five spot on the rental (VoD) chart in 2024 with 285k[85] transactions.

Robert Marsh, Vice President, International Account Management & Sales and UK Home Entertainment, Sony Pictures Entertainment, and Co-Chair DEGI: Digital Entertainment Group International said: “2024 was a good year for Digital Transactional with more Premium window titles availing than ever, a plethora of strong new releases at home and diverse genres hitting the UK’s top selling titles. A great example is ANYONE BUT YOU a romantic comedy which took cinemas and audiences at home by storm, becoming a viral phenomenon and delighting consumers. The title went on to become a Top 5 rental title of the year. This was followed later by IT ENDS WITH US the film based on the Colleen Hoover best-selling book. This title ended up maintaining its #1 VOD chart position for eight weeks at the end of the year, including through the busy Christmas period, as consumers were captivated by the story of Lily Bloom. These two titles show that the digital market is for everyone, from DEADPOOL & WOLVERINE and DUNE: PART TWO to ANYONE BUT YOU and IT ENDS WITH US, there is so much choice available.”

The fan favourite 4K format delivered YoY growth of 21% YoY where the top ten films included 4K re-releases of catalogue titles ALIENS, THE TERMINATOR, THE CROW, THE LORD OF THE RINGS TRILOGY, and DUNE (2021). The top ten 4K titles in the UK in 2024 generated a combined value of £4.4mn, where Sci-fi as a genre is particularly popular with fans, occupying multiple spots in the top ten.

The TV on disc market was once again led by GAME OF THRONES: HOUSE OF THE DRAGON, with the first and second season occupying the number and two spot on the chart. Elsewhere, the DOCTOR WHO franchise continued to prove hugely successfully for BBC, earning a combined total of £200mn across all DOCTOR WHO transactional releases across the year.

Robert Callow, Managing Director, Spirit Entertainment, said: “The continued resilience of the physical market has been extraordinary, catalogue performance has been particularly noteworthy with high value classic TV box sets and a multitude of wonderful back catalogue film special editions being bought to life. With a highly engaged physical retailer base, very strong new release slate and many more innovative catalogue opportunities being planned, 2025 is looking incredibly positive.”

The leading horror title of the year was Paramount Pictures A QUIET PLACE: DAY ONE, selling 232k units across all formats. The horror genre continued to prove a hugely popular choice with audiences in the UK, where Universal Pictures dominated the rest of the Horror top five, with FIVE NIGHTS AT FREDDY’S, ABIGAIL, and THE EXORCIST: BELIEVER taking the 2nd, 4th, and 5th spots respectively in the top unit sales in the Horror Chart. The number three spot was taken by independent distributor BLACK BEAR, with LONGLEGS, with 141k units sold across all formats. LONGLEGS also took the number seven spot on the chart of the top ten Independently distributed titles of the year, where Lionsgate’s THE HUNGER GAMES: THE BALLAD OF SONGBIRDS AND SNAKES claimed the top spot, with 347k sales across all formats, at a value of £3.5mn. This was followed by the STUDIOCANAL Amy Winehouse biopic BACK TO BLACK, which sold 267k units across all formats.

Marie-Claire Benson, EVP/ Head of Motion Picture Group, Lionsgate UK and BASE Co-Chair, said: “Following a buoyant 2024 marked by increased cinema admissions, exceptional results from premium windows, and continued resilience in the physical market, UK entertainment momentum shows no signs of slowing. We saw 22% of the 2024 box office generated in the final seven weeks of 2024, and this success is already translating to digital platforms. The WICKED premium Home Entertainment success has been outstanding, and Lionsgate’s own SMALL THINGS LIKE THESE is outperforming comparable titles, demonstrating the continued growth potential of premium digital formats. The 2025 calendar is robust and diverse: Lionsgate’s upcoming slate includes Mark Wahlberg’s action film FLIGHT RISK, the Oscar- and BAFTA-nominated Iranian drama THE SEED OF THE SACRED FIG, and the future British classic and April 2025 release THE PENGUIN LESSONS, starring Steve Coogan. With something for everyone available across all formats and options, entertainment will continue to deliver this year, and beyond.”

The British Association for Screen Entertainment has represented the UK Visual Home Entertainment category for 45 years. The primary objective of BASE is to champion the growth of screen entertainment, while maintaining a business environment with the fewest regulatory burdens. Our members are represented within the £5.1 billion Home Entertainment market alongside Affiliate and Associate members from a host of critical industry stakeholders.

Official All-Video Chart 2024(Top five charts for each video format and genre, not including box sets)

Official Video Chart 2024 (All Digital; Blu-ray and DVD, EST, TVOD)

1 WONKA

2 DUNE: PART TWO

3 OPPENHEIMER

4 DEADPOOL & WOLVERINE

5 BARBIE

© OFFICIAL CHARTS COMPANY

Official Film Chart 2024 (All Digital Retail; Blu-ray and DVD, EST)

1 DEADPOOL & WOLVERINE

2 WONKA

3 DUNE: PART TWO

4 INSIDE OUT 2

5 OPPENHEIMER

© OFFICIAL CHARTS COMPANY

Official Video Chart 2024 (All Blu-ray & DVD)

1 DUNE: PART TWO

2 WONKA

3 OPPENHEIMER

4 DEADPOOL & WOLVERINE

5 AQUAMAN AND THE LOST KINGDOM

© OFFICIAL CHARTS COMPANY

Official Blu-ray Chart 2024

1 DUNE: PART TWO

2 DEADPOOL & WOLVERINE

3 ALIEN: ROMULUS

4 OPPENHEIMER

5 FURIOSA: A MAD MAX SAGA

© OFFICIAL CHARTS COMPANY

Official DVD Chart 2024

1 WONKA

2 OPPENHEIMER

3 BARBIE

4 DUNE: PART TWO

5 AQUAMAN AND THE LOST KINGDOM

© OFFICIAL CHARTS COMPANY

Official Film Download Chart 2024 (EST)

1 DEADPOOL & WOLVERINE

2 WONKA

3 DUNE: PART TWO

4 INSIDE OUT 2

5 DESPICABLE ME 4

© OFFICIAL CHARTS COMPANY

Official Film Digital Rental Chart 2024 (VOD):

1 OPPENHEIMER

2 WONKA

3 DUNE: PART TWO

4 BARBIE

5 ANYONE BUT YOU

© OFFICIAL CHARTS COMPANY

Official TV on Video Chart 2024

1 GAME OF THRONES: HOUSE OF THE DRAGON – SEASON 1

2 GAME OF THRONES: HOUSE OF THE DRAGON – SEASON 2

3 THE LAST OF US – SEASON 1

4 DOCTOR WHO: THE CELESTIAL TOYMAKER

5 WEDNESDAY – SEASON 1

© OFFICIAL CHARTS COMPANY

[1] Omdia

[2] Omdia

[3] Omdia

[4] Kantar

[5] Comscore

[6] British Association for Screen Entertainment

[7] British Association for Screen Entertainment

[8] Official Charts Company

[9] Official Charts Company

[10] FutureSource Consulting

[11] Official Charts Company

[12] Official Charts Company

[13] FutureSource Consulting

[14] FutureSource Consulting

[15] FutureSource Consulting

[16] Omdia 2023

[17] Omdia

[18] Barb Establishment Survey Q3 2024

[19] Barb Establishment Survey Q3 2024

[20] Omdia

[21] Official Charts Company

[22] Warner Bros. Entertainment UK Ltd.

[23] Official Charts Company

[24] Warner Bros. Entertainment UK Ltd.

[25] Official Charts Company

[26] Official Charts Company

[27] Official Charts Company

[28] Universal Pictures, Warner Bros. Entertainment UK Ltd.

[29] Official Charts Company

[30] Official Charts Company, VOD Data to week 51 2024

[31] The Walt Disney Company

[32] Official Charts Company

[33] Official Charts Company

[34] Official Charts Company

[35] Official Charts Company

[36] Sony Pictures UK

[37] Official Charts Company

[38] Official Charts Company

[39] Warner Bros. Entertainment UK

[40] Official Charts Company

[41] Official Charts Company

[42] Spirit Entertainment

[43] Spirit Entertainment

[44] Omdia

[45] FutureSource Consulting

[46] Comscore Movies

[47] FutureSource Consulting

[48] Kantar

[49] UK Cinema Association

[50] British Association for Screen Entertainment

[51] Ampere Analysis – FAST Channels Tracker

[52] Futuresource Consulting

[53] Futuresource Consulting

[54] Futuresource Consulting

[55] Omdia

[56] Omdia

[57] Barb Establishment Survey Q3 2024

[58] Barb Establishment Survey Q3 2024

[59] Barb Establishment Survey Q3 2024

[60] Omdia

[61] Ampere Analysis – Media Consumer

[62] British Association for Screen Entertainment and Official Charts Company

[63] Official Charts Company

[64] Official Charts Company

[65] Official Charts Company

[66] Official Charts Company

[67] Official Charts Company

[68] Official Charts Company

[69] Official Charts Company

[70] Box Office Mojo

[71] Official Charts Company

[72] Box Office Mojo

[73] Official Charts Company

[74] Official Charts Company

[75] Box Office Mojo

[76] StudioCanal

[77] Universal Pictures

[78] The Walt Disney Company

[79] Paramount Pictures

[80] The Walt Disney Company

[81] Official Charts Company

[82] Official Charts Company

[83] Box Office Mojo

[84] Official Charts Company

[85] Official Charts Company